The Rise of Crypto Diplomacy: How Bitcoin and Ethereum are Shaping International Relations

Sources

- Top 3 Major Crypto Events That Will Strongly Impact the Market This Week - Coingape

- Gold vs Bitcoin: Can BTC Outperform Gold Ahead in 2026? - Coingape

- Top Bitcoin Rich Lists: Who owns the most BTC in 2026? - Coingape

- Trump’s Speech on Tariffs at Davos: What to Expect for Crypto Market? - Coingape

- Native American Tribes Kalshi Prediction Markets Siphon Money - Decrypt (Jan 21, 2026)

- Steak n Shake to Pay Bitcoin Bonus to Hourly Employees: How Much? - Decrypt (Jan 21, 2026)

- Ethereum Price Sentiment Bearish, Myriad Traders - Decrypt (Jan 21, 2026)

- What's Going On: Elon Musk, Ryanair - Decrypt (Jan 21, 2026)

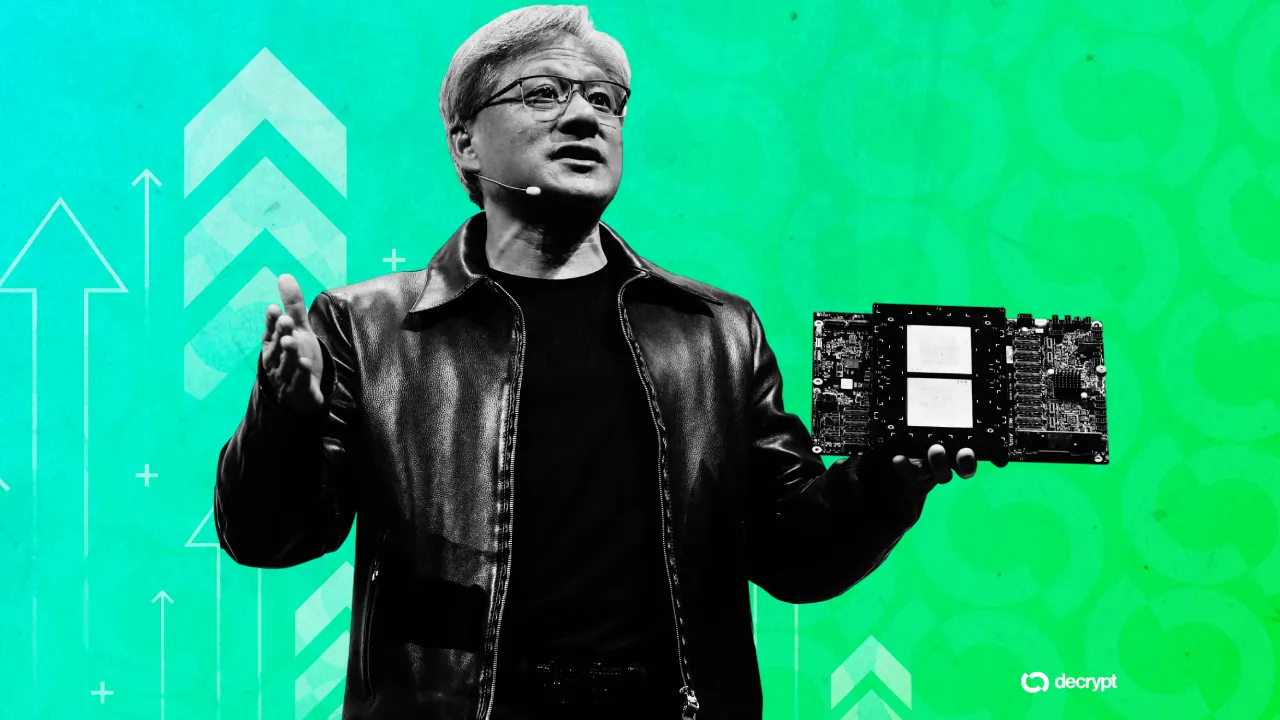

- What Bubble? Nvidia CEO Says AI Needs Trillions More Investments - Decrypt (Jan 21, 2026)

- BlackRock: Ethereum Is Anchoring Wall Street's Tokenization Race - Decrypt

Introduction: The Intersection of Crypto and Diplomacy

Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have transcended their origins as speculative assets, emerging as instruments in the arsenal of international diplomacy. In an era of escalating geopolitical tensions, nations and non-state actors are leveraging decentralized networks to circumvent traditional financial systems, forge new trade alliances, and assert digital sovereignty. This "crypto diplomacy" diverges from conventional market analysis by spotlighting how BTC's scarcity mirrors gold's historical role in power projection, while ETH's smart contracts enable tokenized real-world assets (RWAs) that could redefine bilateral agreements. Recent developments, such as BlackRock's endorsement of ETH as the backbone for Wall Street's tokenization efforts, underscore this shift, positioning crypto not just as a hedge but as a geopolitical lever. As U.S. President-elect Donald Trump's upcoming Davos speech on tariffs looms—potentially reshaping global trade flows—cryptocurrencies offer both opportunities and flashpoints in international relations.

Historical Context: Cryptocurrencies as Tools of Political Influence

History is replete with currencies serving as weapons in diplomatic arsenals. The 1971 Nixon Shock, which ended the Bretton Woods gold standard, triggered currency wars that realigned global alliances, much like today's U.S. dollar dominance via SWIFT sanctions has isolated nations like Russia and Iran. The petrodollar system of the 1970s, where Saudi Arabia priced oil in USD, cemented American influence; parallels abound in crypto, where BTC's fixed supply of 21 million coins evokes gold's neutrality, potentially challenging fiat hegemony.

Drawing from recent analyses, BTC's positioning against gold—projected to outperform by 2026 per market forecasts—mirrors these dynamics. Whales atop Bitcoin rich lists, including governments and institutions holding over 1 million BTC each, wield influence akin to central banks in past eras. Social media amplifies this: Elon Musk's X posts criticizing legacy airlines like Ryanair while praising Dogecoin have sparked debates on crypto's soft power, echoing how currency devaluations once swayed elections. Crypto's borderless nature now enables sanctioned entities to bypass USD rails, much as the 1998 Russian financial crisis prompted ruble swaps with trading partners.

The Role of Major Players: Bitcoin, Ethereum, and Global Power Dynamics

Bitcoin and Ethereum anchor this diplomatic evolution. BTC, often dubbed "digital gold," serves nations building strategic reserves. El Salvador's 2021 adoption as legal tender was a diplomatic gambit for remittances and tourism, while Russia's post-Ukraine invasion pivot to crypto mining for energy exports signals a hedge against SWIFT exclusion. Bitcoin rich lists reveal U.S.-based entities like MicroStrategy dominating holdings, but emerging players—rumored nation-state accumulators—tilt power balances.

Ethereum's programmable blockchain elevates its diplomatic utility. BlackRock's recent statement positions ETH as central to tokenizing trillions in assets, enabling fractional ownership of infrastructure or commodities for cross-border deals without intermediaries. This aligns with Wall Street's race but raises sovereignty concerns: U.S. firms like BlackRock could embed American regulatory preferences globally. Trump's Davos tariffs rhetoric, as previewed in analyses, might accelerate this by pressuring allies into BTC/ETH settlements, countering China's digital yuan push. Community sentiment on X reflects skepticism; traders note ETH's bearish price outlook amid network congestion, questioning its scalability for high-stakes diplomacy.

Case Studies: Successful Applications of Crypto in International Relations

Real-world examples illustrate crypto's diplomatic bite. Native American tribes' embrace of Kalshi prediction markets—siphoning funds via decentralized betting on events—demonstrates sovereignty assertion outside federal oversight, akin to micro-diplomacy. In emerging markets, Argentina's crypto remittances amid inflation crises facilitate unofficial trade with Brazil, evading capital controls.

Sanctions evasion stands out: Reports indicate Russia and Iran using BTC mixers for oil trades with India and China, preserving alliances despite U.S. pressure. Corporate precedents like Steak n Shake's Bitcoin bonuses for U.S. employees hint at broader adoption, potentially influencing labor diplomacy in unionized economies. Ethereum shines in DeFi pilots; tokenized bonds on ETH have enabled Ukraine to raise funds rapidly during conflict, bypassing slow IMF processes. These cases, while innovative, fuel hype—community forums like Reddit's r/cryptocurrency debate their scale, with skeptics citing 2022's Luna collapse as a caution against overreliance.

Challenges and Risks: Navigating the Crypto Diplomatic Landscape

Crypto diplomacy is fraught with pitfalls. Volatility undermines trust: ETH's current bearish sentiment, with traders eyeing sub-$3,000 levels, could derail negotiations if a deal's value swings 20% overnight. Regulatory fragmentation poses hurdles; the EU's MiCA framework clashes with U.S. SEC spot ETF approvals, complicating multinational pacts.

Geopolitical risks loom larger. Nvidia CEO Jensen Huang's call for trillions in AI investments—potentially tokenized on ETH—intersects with crypto but invites centralization, where a few validators control flows. Sanctions evasion invites retaliation: U.S. Treasury actions against Tornado Cash highlight enforcement creep. International cooperation falters amid digital sovereignty battles; China's crypto ban contrasts with pro-BTC U.S. shifts under Trump. Social media echo chambers amplify misinformation, as seen in Musk's Ryanair spat, polarizing global views on adoption.

Future Trends: Predicting the Next Phase of Crypto Diplomacy

Emerging tensions forecast crypto's amplified role. Trade wars, intensified by Trump's Davos tariffs speech, may spur BTC/ETH corridors—e.g., BRICS nations piloting stablecoins against USD dominance. Digital sovereignty drives state-backed chains; expect Ethereum forks for compliant RWAs, per BlackRock's vision.

Geopolitical flashpoints like U.S.-China decoupling could boost BTC as neutral reserve, outperforming gold by 2026 if halving cycles align with inflation. Prediction markets on platforms like Kalshi may evolve into diplomatic tools for hedging election outcomes or conflicts. Upcoming events—major crypto catalysts this week, including ETF flows—will test resilience. Skeptically, adoption hinges on layer-2 scaling; without it, ETH congestion could stall momentum. AI-crypto convergence, fueled by Nvidia's trillions pledge, might tokenize data sovereignty pacts, but bubbles loom.

Conclusion: The New Age of Diplomacy in a Digital World

Crypto diplomacy marks a paradigm shift, with Bitcoin's scarcity and Ethereum's versatility reshaping alliances much like gold and dollars once did. From sanctions workarounds to tokenized trade, BTC and ETH empower the marginalized while challenging incumbents. Yet, volatility, regulation, and centralization risks temper optimism—hype often outpaces utility, as community discourse reveals. Understanding these geopolitical undercurrents is crucial for stakeholders; as tensions mount, cryptocurrencies won't just reflect international relations—they'll actively forge them. Policymakers must balance innovation with safeguards to harness this digital frontier without unintended escalations.

What This Means

As cryptocurrencies continue to evolve, their role in international relations will likely expand. Policymakers and stakeholders must remain vigilant, adapting to the rapid changes in the crypto landscape. The potential for cryptocurrencies to facilitate trade, assert sovereignty, and challenge traditional power structures presents both opportunities and challenges that require careful navigation.

*By Ryan Torres, Crypto & DeFi Analyst for The World Now. Word count: 1,248. This analysis is for informational purposes only and does not constitute financial advice.