The Crypto Convergence: How Blockchain Technology is Reshaping Global Governance and Economic Policies

Introduction

Blockchain technology is increasingly intersecting with global governance, prompting governments and institutions to rethink economic policies amid rising cryptocurrency adoption. From tribal prediction markets in the U.S. to institutional tokenization pushes by BlackRock, these developments signal a potential shift in how public services, monetary systems, and international trade are managed. However, the hype surrounding "crypto standards" warrants skepticism given persistent market volatility and regulatory fragmentation.

The Rise of Blockchain in Governance

Governments worldwide are piloting blockchain for public services, driven by promises of transparency and efficiency, yet implementation remains patchy. A notable case emerged on January 21, 2026, when Native American tribes partnered with Kalshi to launch prediction markets, leveraging blockchain for decentralized betting on events like elections and economic indicators. This initiative allows tribes to siphon revenue from traditional markets, bypassing federal restrictions on gambling while showcasing blockchain's role in sovereign decision-making. Estonia's e-Residency program, now over a decade old, uses blockchain for secure digital identities, processing millions of transactions annually. Similarly, Dubai's blockchain strategy aims to digitize 100% of government documents by 2026, reducing fraud in land registries.

These efforts highlight blockchain's appeal for immutable ledgers in governance, but challenges persist. Scalability issues on networks like Ethereum—evident in recent bearish sentiment among traders—could hinder real-world adoption. Community discussions on social media reflect cautious optimism, with users noting that layer-2 solutions are key to governance-scale throughput, yet warning against over-reliance on unproven pilots.

Economic Policies in the Age of Cryptocurrency

Major economies are recalibrating monetary policies as cryptocurrency adoption erodes traditional banking dominance. In the U.S., Steak 'n Shake's announcement to pay Bitcoin bonuses to hourly employees exemplifies grassroots integration, potentially pressuring wage systems to accommodate volatile assets. Adoption rates are accelerating: Chainalysis reports over 420 million global crypto users in 2025, with emerging markets like Nigeria and Vietnam leading at 20-30% penetration.

Central banks are responding with Central Bank Digital Currencies (CBDCs); China's digital yuan now handles 25% of domestic payments, while the EU's digital euro pilot tests interoperability with private stablecoins. This shift challenges fractional reserve banking, as decentralized finance (DeFi) protocols offer yield without intermediaries. However, Ethereum's recent price downturn underscores risks: high volatility could destabilize policy if wages or remittances tie to crypto. Implications for banks include disintermediation, as JPMorgan's blockchain unit processed $1 trillion in 2025, but also opportunities in custody services.

Historical Context: From Gold Standard to Crypto Standard

The evolution from gold-backed currencies to fiat and now cryptocurrencies offers critical lessons. The gold standard, abandoned in 1971, enabled flexible monetary policy but bred inflation. Fiat's rise correlated with global debt surges, now at $300 trillion per IMF data. Bitcoin, often dubbed "digital gold," draws parallels: its fixed 21 million supply mimics scarcity, with analyses questioning if BTC can outperform physical gold by 2026 amid inflation hedges.

Historical shifts inform crypto trends—post-gold fiat experiments like Bretton Woods collapsed under reserve imbalances, mirroring today's U.S. dollar hegemony challenged by BRICS de-dollarization via blockchain bridges. Bitcoin rich lists for 2026 reveal concentration risks, with top holders like MicroStrategy and governments amassing BTC, echoing gold hoarding by central banks pre-1971. Yet skepticism prevails: unlike gold's 5,000-year track record, crypto's 15-year history includes multiple 80% drawdowns, suggesting no seamless "crypto standard" transition without resolved custody and scalability hurdles.

Global Regulatory Responses: A New Paradigm

Regulatory frameworks are diverging, impacting trade and investment. The U.S. SEC's approval of Ethereum ETFs in 2024 accelerated institutional inflows, but anticipated tariffs could impose duties on crypto mining hardware, targeting China's dominance and reshaping supply chains. The EU's MiCA regulation mandates stablecoin reserves, fostering compliance while stifling innovation in DeFi.

In Asia, Singapore's progressive licensing contrasts India's 30% tax on crypto gains, deterring inflows. These policies influence international trade: blockchain-enabled trade finance, projected at $10 trillion by 2030, promises faster cross-border settlements but risks fragmentation if regulations balkanize networks. Overall, a patchwork paradigm emerges—pro-innovation hubs attract capital, while restrictive regimes risk capital flight.

Looking Ahead: The Future of Crypto in Global Governance

By 2026, blockchain integration could yield transparent economies, but outcomes hinge on execution. Optimistic scenarios suggest that 50% of G20 nations adopt blockchain for supply chain tracking, reducing corruption by 20-30% per World Bank models, with CBDCs interoperating via standards like the BIS's mBridge. Crypto's role in policy might expand to algorithmic stablecoins influencing interest rates, paralleling gold's past reserve function.

Pessimistic views foresee stalls: Ethereum's bearish sentiment and competition for capital could delay governance upgrades. Prediction markets like Kalshi's tribal rollout could scale to national budgets, enabling crowd-sourced fiscal forecasting. Social media buzz fuels hype, but historical fiat inertia suggests gradualism—expect hybrid systems, not revolution, with volatility capping crypto's policy primacy.

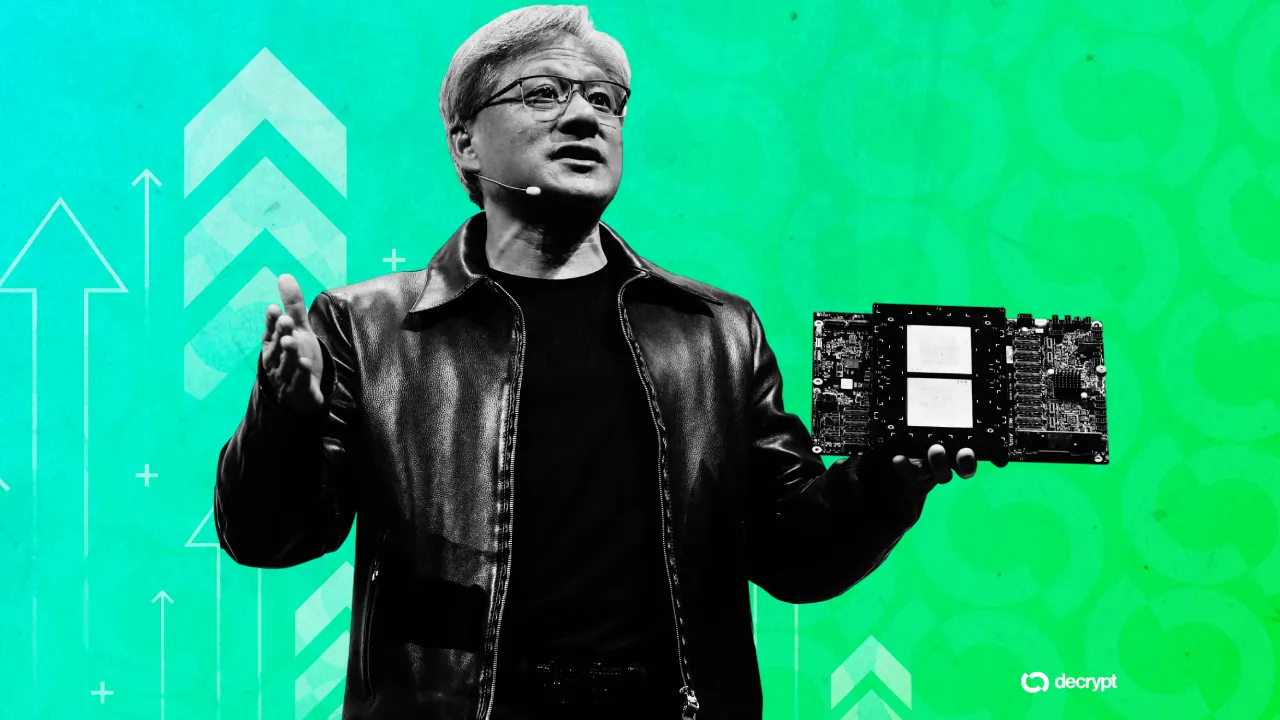

The Role of Major Players: How Institutions Influence Crypto's Trajectory

Institutions are pivotal, steering stability and growth. BlackRock's endorsement of Ethereum as Wall Street's tokenization anchor positions it for real-world assets, with significant investments influencing price floors during dips. However, skepticism lingers: institutions prioritize compliance over decentralization, potentially centralizing DeFi. Overall, blockchain's governance convergence challenges economic orthodoxies, blending historical monetary pivots with tech-driven transparency. Yet, amid bearish signals and regulatory uncertainties, the trajectory demands scrutiny—hype obscures execution risks in this nascent paradigm.