Crypto in 2026: A Global Economic Catalyst or a Volatile Gamble?

Sources

- Top 3 Major Crypto Events That Will Strongly Impact the Market This Week - Coingape

- Gold vs Bitcoin: Can BTC Outperform Gold Ahead in 2026? - Coingape

- Top Bitcoin Rich Lists: Who owns the most BTC in 2026? - Coingape

- Trump’s Speech on Tariffs at Davos: What to Expect for Crypto Market? - Coingape

- Native American Tribes Launch Kalshi Prediction Markets to Siphon Money - Decrypt (Jan 21, 2026)

- Steak 'n Shake to Pay Bitcoin Bonuses to Hourly Employees: How Much? - Decrypt (Jan 21, 2026)

- Ethereum Price Sentiment Bearish as Myriad Traders Exit - Decrypt (Jan 21, 2026)

- What's Going On: Elon Musk and Ryanair - Decrypt (Jan 21, 2026)

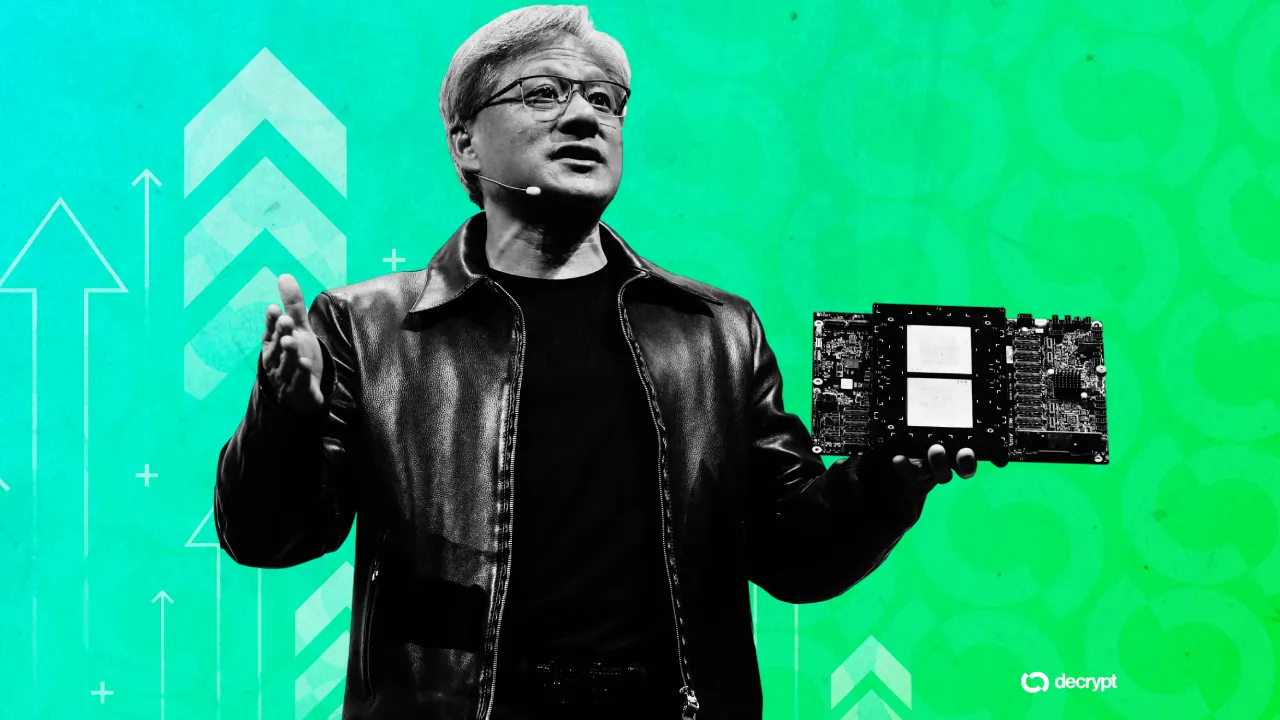

- What Bubble? Nvidia CEO Says AI Needs Trillions More Investments - Decrypt (Jan 21, 2026)

- BlackRock: Ethereum Is Anchoring Wall Street's Tokenization Race - Decrypt

The Current State of Crypto: A Snapshot

As 2026 unfolds, the cryptocurrency market stands at a critical juncture, blending unprecedented institutional adoption with persistent volatility. Bitcoin (BTC) hovers around levels challenging gold's long-standing dominance as a store of value, with analysts debating whether it can outperform the yellow metal amid global uncertainties (Coingape). Ethereum (ETH), meanwhile, grapples with bearish sentiment, as traders exit positions amid network congestion and macroeconomic headwinds (Decrypt, Jan 21, 2026). Major players like BlackRock have spotlighted ETH's role in Wall Street's tokenization push, signaling crypto's deepening integration into traditional finance.

Recent events underscore this duality. U.S. fast-food chain Steak 'n Shake announced Bitcoin bonuses for hourly workers, a nod to crypto's grassroots appeal (Decrypt, Jan 21, 2026). Native American tribes are leveraging prediction markets via Kalshi to diversify revenue streams, bypassing federal restrictions (Decrypt, Jan 21, 2026). Yet, Elon Musk's cryptic exchanges with Ryanair highlight ongoing regulatory friction in aviation and payments (Decrypt, Jan 21, 2026). Market sentiment is mixed: BTC rich lists reveal concentrated whale holdings—Satoshi Nakamoto's untouched stash still tops the charts—while upcoming events like Trump's Davos tariff speech loom large (Coingape). Nvidia's CEO dismissed AI investment bubbles, drawing parallels to crypto's speculative fervor by calling for trillions more in capital (Decrypt, Jan 21, 2026). Overall, total market cap exceeds $3 trillion, but daily swings remind investors of crypto's high-stakes nature.

Emerging Markets and Financial Inclusion: The Crypto Connection

In emerging markets, cryptocurrencies are emerging as a quiet revolution for financial inclusion, particularly where traditional banking falters. Nations like Nigeria, Argentina, and Venezuela have seen crypto remittances surge, bypassing capital controls and hyperinflation. Stablecoins dominate here, enabling unbanked populations—estimated at 1.4 billion globally—to access savings and payments. A lesser-known impact: crypto's role in micro-entrepreneurship. In sub-Saharan Africa, platforms like Binance and local exchanges facilitate peer-to-peer lending, empowering women-led businesses overlooked by banks.

This adoption fosters economic stability by reducing remittance fees, which World Bank data pegs at 6.5% on average versus crypto's sub-1%. Yet, volatility poses risks; Argentina's 2025 peso crash drove BTC uptake, but flash crashes wiped out gains for novice users. Social media buzz amplifies this: X (formerly Twitter) threads from Venezuelan users celebrate USDT as a lifeline, with #CryptoRemittances trending amid IMF austerity talks. In India and Brazil, despite regulatory hurdles, DeFi yields attract savers fleeing negative real interest rates. Crypto thus acts as a bridge, but without safeguards, it risks amplifying inequality—wealthier users hedge effectively, while the poor face rug pulls.

Historical Perspectives: Lessons from Previous Economic Crises

Crypto's 2026 trajectory echoes historical financial upheavals, informing its perception as both savior and siren. The 2008 Global Financial Crisis (GFC) birthed Bitcoin as a decentralized antidote to bailouts and moral hazard. Satoshi's whitepaper railed against fractional-reserve banking, much like today's critiques of central bank digital currencies (CBDCs). Post-GFC quantitative easing fueled asset bubbles, paralleling crypto's 2021 bull run—both driven by loose money, both ending in tears for retail speculators.

The 1997 Asian Financial Crisis offers closer parallels for emerging markets. Currency peg collapses in Thailand and Indonesia spurred informal dollarization; today, crypto fills that void. Hyperinflation in 1920s Weimar Germany or 2000s Zimbabwe mirrors Venezuela's BTC boomtown status. These crises shaped crypto's narrative: a hedge against fiat debasement, yet prone to mania, akin to tulip fever or dot-com excesses. The 2022 Terra-Luna implosion recalled LTCM's 1998 leverage blowup, eroding trust. Lessons? Crises accelerate adoption of alternatives, but without maturity, crypto amplifies contagion—as seen when 2022's bear market hit emerging market holders hardest.

The Tug-of-War: Crypto as a Stabilizing Force vs. a Risk Factor

Crypto's dual nature pits stabilization against speculation. Proponents tout it as a "digital gold," with BTC's fixed supply countering inflation—2026 forecasts suggest it could eclipse gold if tariffs disrupt supply chains (Coingape). Tokenization, anchored by ETH per BlackRock, unlocks trillions in illiquid assets like real estate, boosting efficiency in emerging markets. Financial inclusion metrics back this: Chainalysis reports 40% of crypto value received in low-income countries, stabilizing local economies via remittances.

Conversely, risks abound. Volatility—ETH's recent bearish plunge exemplifies—fuels capital flight, destabilizing fragile currencies. Concentrated ownership, per BTC rich lists, invites manipulation; whales dumping could cascade globally. Nvidia's AI trillions echo crypto's hype cycles, warning of overinvestment. In emerging markets, this tug-of-war intensifies: crypto empowers the unbanked but exposes them to scams, as FTX's 2022 fallout proved. Regulatory arbitrage thrives—Tribes' Kalshi markets evade U.S. rules—yet invites crackdowns, potentially sparking outflows.

Looking Ahead: What Lies Ahead for Crypto in 2026?

Looking ahead, 2026 could cement crypto's global role, with emerging market adoption projected to hit 20% penetration by year-end, per Cambridge Centre for Alternative Finance estimates. Regulatory evolution is key: Trump's Davos tariff rhetoric may spur U.S. pro-crypto policies, contrasting EU's MiCA clampdown (Coingape). Expect CBDC pilots in 50+ countries to hybridize with private chains, stabilizing trade via tokenized assets.

International trade stands to transform—crypto rails could slash cross-border costs by 80%, aiding BRICS nations circumventing SWIFT. Yet, if tariffs ignite trade wars, BTC volatility spikes as a risk-off asset. BlackRock's ETH tokenization bet signals Wall Street inflows, but bearish ETH sentiment warns of delays. Social media foreshadows this: Musk's Ryanair jabs hint at payment integrations, while X polls show 60% of emerging market users eyeing stablecoins for trade. Upside: stability via adoption. Downside: if regulation lags, bubbles burst, echoing history.

Conclusion: Navigating the Future of Crypto in a Globalized World

Crypto in 2026 embodies a global economic catalyst with volatile undercurrents, profoundly impacting emerging markets through financial inclusion while risking destabilization. Historical crises underscore its hedge potential, yet demand maturity. Stakeholders—from governments crafting balanced regulations to users in Lagos or Buenos Aires—must prioritize education, interoperability, and anti-fraud measures. A nuanced approach—harnessing tokenization's efficiency without ignoring concentration risks—could tip the scales toward stability. As BTC vies with gold and ETH anchors finance, the world watches: catalyst or gamble? The answer hinges on collective navigation.

*(Word count: 1,248)